Stamp Duty Holiday – What has changed?

Stamp Duty can already be a confusing concept, so we’re here to help you understand what the recent Stamp Duty Holiday means for you when buying your new home.

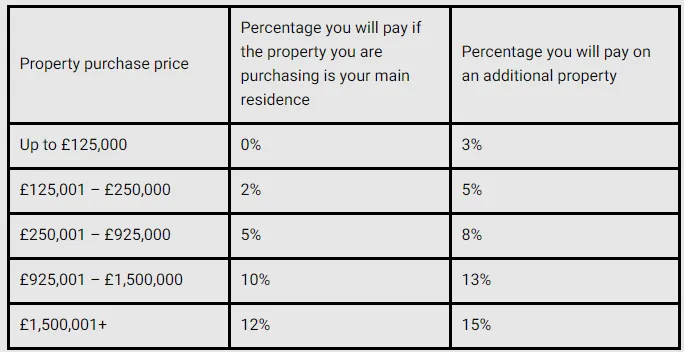

What were the old rules?

Before the 8th July, when you purchased a new home you had to pay Stamp Duty Land Tax (SDLT), which varied depending on how much your home was worth, whether you were a first time buyer and if this was your only home:

First Time Buyers did not have to pay Stamp Duty on the first £300,000 of their new home, and from there only 5% on any amount between £300,001 and £500,000.

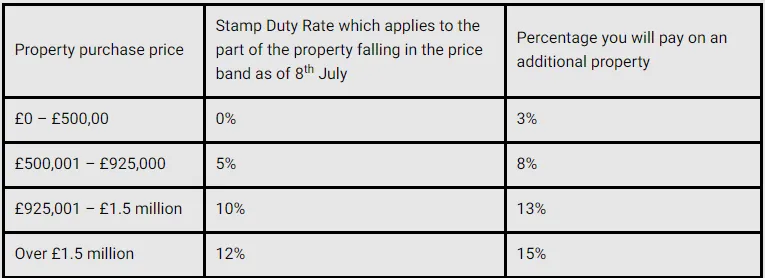

What has changed?

As of 8th July until 31st March 2021, you will not have to pay Stamp Duty on any homes up to the price of £500,000.

This also benefits First Time Buyers, who now do not have to pay Stamp Duty on up to £500,000 of their new home!

What sort of savings does this mean I could get?

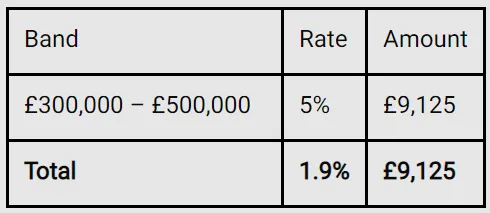

Let’s take a look for example at Harrow One, one of our newest developments in Harrow.

Before today, if you were a First Time Buyer purchasing one of our 2-bedroom apartments for £482,500, you would have had to pay £9,125 in Stamp Duty Land Tax:

Now, you will not have to pay any Stamp Duty, saving you over £9,000!

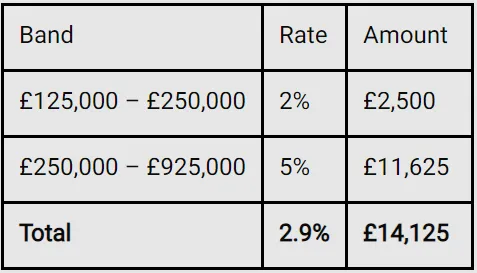

If you were not a first time buyer but wanted to purchase this apartment at Harrow One, you would have had to pay £14,125 in Stamp Duty Land Tax:

Now, even if you aren’t a first time buyer, you will still be saving over £14,000!

Take advantage of these fantastic savings today by viewing our new homes!